Årsopgørelse: How to check whether you are due money as Denmark releases tax returns

Monday March 13th is the release date for this year’s annual Danish tax return, the ‘årsopgørelse’.

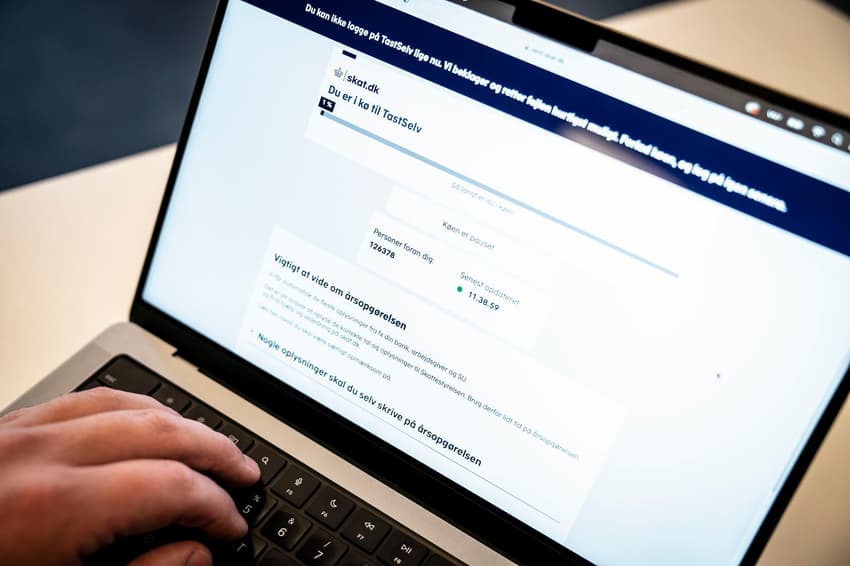

The Danish Tax Authority, Skattestyrelsen, opened access to the årsopgørelse or annual tax return on Monday morning.

As is always the case when the yearly tax statements are released, there is heavy traffic on the skat.dk website so some queuing and waiting will be likely throughout the day for taxpayers logging on to the platform to check their returns.

I dag er årsopgørelsen officielt i luften 🎉

Alle mand er på dæk, og vi er klar til at hjælpe jer indtil til kl. 17. Der kan være øget ventetid den kommende tid. Telefonerne åbner kl. 9, så et tip kan være at kontakte os her eller på chatten, hvor vi sidder klar kl. 8. #SkatDK pic.twitter.com/VzGsS5lfMO

— Skattestyrelsen (@Skattestyrelsen) March 13, 2023

Annual tax returns (årsopgørelser) in Denmark cover calendar years. They are released in March and finalised in late spring, meaning taxpayers have this period to correct the information on their tax returns from the previous calendar year.

The returns account for income over the preceding tax year as well as deductions and taxes paid.

Too much tax paid during the preceding year (without adjustment of the preliminary tax return, forskudsopgørelse during the course of that year), can mean the tax payer is due a tax refund. This will show on the annual return on its release in March.

The reverse applies if less than the correct rate has been paid for that person’s individual circumstances, meaning money might be owed to the Danish tax system. Repayments must be made by July 1st.

Once you have logged on to the platform, you can click on 'årsopgørelse' to see your return for 2023. Money due to be repaid to you will display as a green figure. If you have to pay money back, the number will be in red.

The annual tax return can be manually adjusted, such as by changing information relating to income or deductions, until May 1st.

For example, journeys of more than 24 kilometres to and from workplaces are eligible for a transport deduction, kørselsfradraget in Danish. The number of days in which you travelled to work, and the distance travelled, can be entered manually and corrected on the annual return if it is too high or too low. This can be relevant for people with flexible work-from-home arrangements.

READ ALSO: Forskudsopgørelse: Why checking your preliminary Danish tax return matters

Normally, around three in four people receive money back from the tax authorities once the return is finalised. The amount paid back varies and depends on individual circumstances.

Rebates from the tax system are automatically paid back, usually beginning in April.

I’m a Danish taxpayer. What do I need to know about this and what should I do?

The annual tax overview, årsopgørelsen, shows your income, deductions and what you have paid in taxes in the last tax year.

The annual statement is released annually in March, when you can see if you are owed money back or if you paid too little in taxes during the preceding year. In most cases, rebates are automatically deposited into your bank account.

In 2023, you can view and correct your 2022 annual statement from March 13th.

Most of the information in the annual statement is provided automatically by your employer or bank. If the information is correct, you do not need to take any further action.

However, you may need to enter some things into the report yourself, depending on your income type and whether you are entitled to any deductions.

These include deductions for transport (kørselsfradrag), child support (børnebidrag) and work clothing and equipment. You also need to enter details of income from shareholdings and properties you own.

More in-depth detail on how these deductions and declarations work can be found on the Tax Agency website (in Danish) with some detail also provided on the website’s English language version.

The Danish Tax Agency can be contacted via telephone in case of queries regarding your annual return. The telephone number to contact the agency is 7222 2828.

READ ALSO: Does Denmark really have the highest tax in the world?

Comments

See Also

The Danish Tax Authority, Skattestyrelsen, opened access to the årsopgørelse or annual tax return on Monday morning.

As is always the case when the yearly tax statements are released, there is heavy traffic on the skat.dk website so some queuing and waiting will be likely throughout the day for taxpayers logging on to the platform to check their returns.

I dag er årsopgørelsen officielt i luften 🎉

— Skattestyrelsen (@Skattestyrelsen) March 13, 2023

Alle mand er på dæk, og vi er klar til at hjælpe jer indtil til kl. 17. Der kan være øget ventetid den kommende tid. Telefonerne åbner kl. 9, så et tip kan være at kontakte os her eller på chatten, hvor vi sidder klar kl. 8. #SkatDK pic.twitter.com/VzGsS5lfMO

Annual tax returns (årsopgørelser) in Denmark cover calendar years. They are released in March and finalised in late spring, meaning taxpayers have this period to correct the information on their tax returns from the previous calendar year.

The returns account for income over the preceding tax year as well as deductions and taxes paid.

Too much tax paid during the preceding year (without adjustment of the preliminary tax return, forskudsopgørelse during the course of that year), can mean the tax payer is due a tax refund. This will show on the annual return on its release in March.

The reverse applies if less than the correct rate has been paid for that person’s individual circumstances, meaning money might be owed to the Danish tax system. Repayments must be made by July 1st.

Once you have logged on to the platform, you can click on 'årsopgørelse' to see your return for 2023. Money due to be repaid to you will display as a green figure. If you have to pay money back, the number will be in red.

The annual tax return can be manually adjusted, such as by changing information relating to income or deductions, until May 1st.

For example, journeys of more than 24 kilometres to and from workplaces are eligible for a transport deduction, kørselsfradraget in Danish. The number of days in which you travelled to work, and the distance travelled, can be entered manually and corrected on the annual return if it is too high or too low. This can be relevant for people with flexible work-from-home arrangements.

READ ALSO: Forskudsopgørelse: Why checking your preliminary Danish tax return matters

Normally, around three in four people receive money back from the tax authorities once the return is finalised. The amount paid back varies and depends on individual circumstances.

Rebates from the tax system are automatically paid back, usually beginning in April.

I’m a Danish taxpayer. What do I need to know about this and what should I do?

The annual tax overview, årsopgørelsen, shows your income, deductions and what you have paid in taxes in the last tax year.

The annual statement is released annually in March, when you can see if you are owed money back or if you paid too little in taxes during the preceding year. In most cases, rebates are automatically deposited into your bank account.

In 2023, you can view and correct your 2022 annual statement from March 13th.

Most of the information in the annual statement is provided automatically by your employer or bank. If the information is correct, you do not need to take any further action.

However, you may need to enter some things into the report yourself, depending on your income type and whether you are entitled to any deductions.

These include deductions for transport (kørselsfradrag), child support (børnebidrag) and work clothing and equipment. You also need to enter details of income from shareholdings and properties you own.

More in-depth detail on how these deductions and declarations work can be found on the Tax Agency website (in Danish) with some detail also provided on the website’s English language version.

The Danish Tax Agency can be contacted via telephone in case of queries regarding your annual return. The telephone number to contact the agency is 7222 2828.

READ ALSO: Does Denmark really have the highest tax in the world?

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.