EXPLAINED: How to understand your Danish payslip

Danish payslips can have a lot of terms that are difficult to understand, technically as well as linguistically.

Our guide helps you to understand your payslip and the terminology used for salary paperwork.

Generally (but not always), if you are an employee at a Danish company, you will receive your wages once a month, usually on the last or first working day. You should also get a wage slip or payslip: lønseddel in Danish. The payslip can be considered a receipt showing how much you have been paid and what you receive net taxes.

Your name, address and personal registration or CPR number along with the period covered by the payslip should all be included on the paperwork. Your employer’s name, address company registration (CVR) number and the day’s date should also be stated.

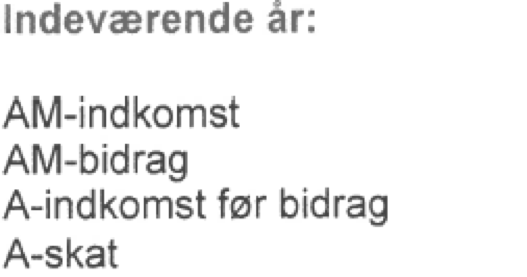

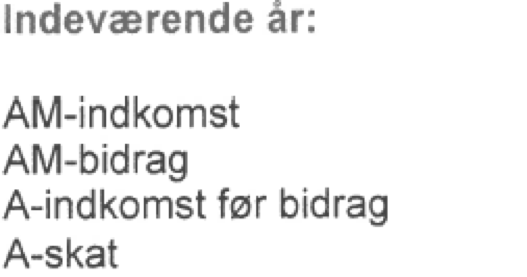

You will see the following terms accompanied by a corresponding amount:

AM-bidrag

AM-bidrag or arbejdsmarkedsbidrag, literally ‘labour market contribution’ is a taxation amounting to 8 percent of your wages. It is paid directly to the Danish Tax Agency (SKAT) by your employer (for those who are not self-employed or freelance).

Your wage slip will tell you the amount to which this 8 percent taxation is applied: some parts of your gross income are not applicable to the AM-bidrag. More information on this below.

A detail from a Danish payslip.

A-skat

This is the primary form of income tax, paid directly to SKAT by your employer on your behalf.

Your payslip will also tell you how much of your income A-skat is applied to after supplements and deductions are applied to your gross wage. The amount you have already paid as AM-bidrag is deducted, for example as are pension contributions and other deductions to which you may be entitled.

ATP-bidrag

ATP stands for Arbejdsmarkedets Tillægspension, which translates to ’labour market pension contribution’. This is a pension into which you are legally obliged to pay and which supplements the state pension (folkepension).

Your employer pays two-thirds of the ATP contribution, you one third comes from your wage. This is the amount you will see on your payslip.

How much you actually pay depends on how you receive your wages, but if you are paid monthly it will be 94.65 kroner (for 2019). Your employer contributes 189.35 kroner, adding up to 284 kroner per month.

AM-Pension

Arbejdsmarkedspension and other pension contributions will be recorded on your payslip. You may see the terms AM-pension firma or AM-pension egen, depending on the type of pension you may pay into.

Read more about how pensions work in Denmark here.

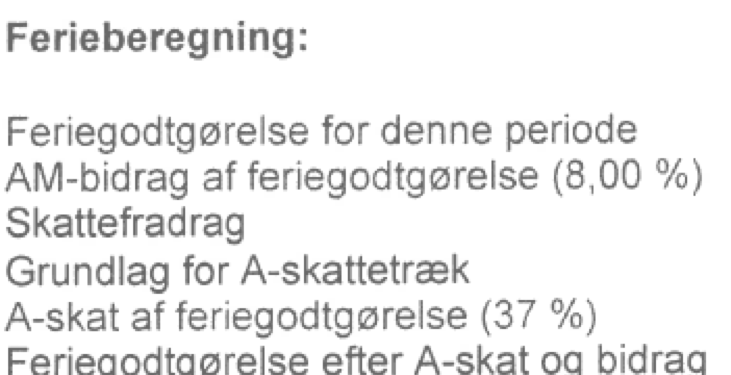

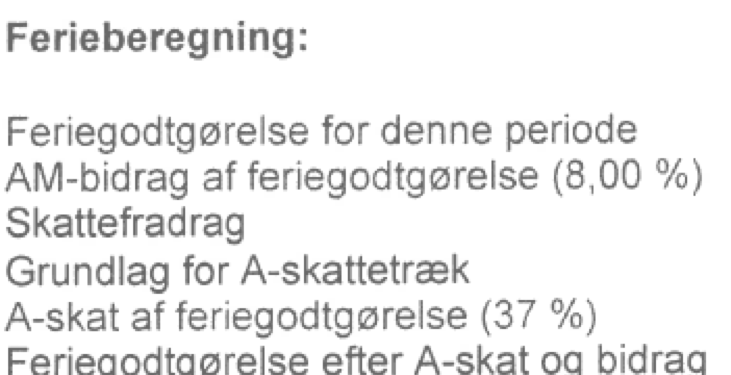

Feriepenge

Feriepenge or ‘holiday money’ is a monthly contribution paid into a special fund, depending on how much you earn.

You can claim back the money once per year, provided you actually take holiday from work. You will be notified when the money can be paid out around May, and directed to the borger.dk website, from where you claim it back from national administrator Udbetaling Danmark.

There are two sub-types of feriepenge. These are ferie med løn, whereby you are paid while on holiday – in this case you are entitled to a supplement of about 1 percent to your wages. If you are not paid while on holiday, you will receive feriegodtgørelse as part of your wages and will see this on your payslip. This means that your employer is obliged by law to pay 12.5 percent of your wages in holiday money into the national pool for you to claim back each year, equivalent to five weeks’ holiday.

READ ALSO: What you need to know about vacation in Denmark – and how the rules are changing

A detail from a Danish payslip.

Whether or not you are entitled to paid holiday or the feriegodtgørelse wage supplement will likely depend on the contract or collective bargaining agreement you have, either as an individual or a member of a trade union.

READ ALSO: EXPLAINED: Should I sign up with a Danish union and get unemployment insurance?

Fradrag

Literally ‘(tax) deduction’, fradrag is the part of your income which can be exempted from taxation. It is calculated by SKAT based on information the tax agency has about you and on information provided by you to your employer. Your employer will be informed how much of your wage is encompassed by fradrag. Your net earnings will therefore reflect that you have paid A-skat on the part of your wage to which tax exemption or fradrag does not apply.

Fradrag can be given for a range of things, including membership fees for unemployment insurance (A-kasse) and trade unions and other expenses. You can check what your are entitled to here (in Danish).

READ ALSO: What Denmark's new budget proposal means for foreign residents

Two other important terms come into play here for people who have more than one employer: hovedkort (primary tax card) and bikort (secondary tax card). Your fradrag can only be applied to one employer at a time, so you should always ask your main employer to use your hovedkort for tax payments, and other employers to use the bikort. The bikort shows only your tax percentage and not the fradrag reductions to your tax payment.

Going further, because monthly wages tax returned via the bikort do not use fradrag, that does not mean you don’t get the tax deductions. These are calculated by SKAT after the event and you will be informed of them via two statements known as forskudsopgørelse and årsopgørelse.

These are both forms of yearly tax accounts. The forskudsopgørelse is issued in November and shows your expected income and tax for the coming year, and you can make changes to it to change how much tax you are paying if the information doesn’t match up with your actual earnings.

The årsopgørelse is an annual statement, released in March, and tells you your income for the past year and what you paid in tax.

If you have paid too much or too little in tax in relation to your earnings, this final statement will inform you of this and any subsequent tax rebates you may be due (you may also owe tax). The money is paid out or collected automatically.

Månedslønnet

If you are paid monthly, this word, which means ‘paid monthly’, is relevant and also means that your grundløn or basic wage will be marked on your payslip. This is the basic wage before any supplements are added and before tax and other payments are taken from your earnings. You will also see timetal or the number of hours you have worked – typically 160.33 hours for someone in full-time work, but dependent on your contract and other factors such as whether you work nights.

Further to this, normtid is your regular or expected working hours, and overtid denotes overtime.

Other terms:

Brutto: The Danish word for ‘gross’, i.e. the amount prior to calculation and deduction of tax.

Netto: Not a supermarket in this context, but the amount of wages you receive after tax.

Disponibel dato or disp. dato: This is the date your wages will be paid out into your bank account.

Enheder: Units, i.e. a month, an hour, a krone and so on.

Sats: the rate, for example an hourly wage or the percentage of wage you pay into a pension scheme.

Timeløn: your hourly pay rate. If applicable, you will see this together with the number of hours (enheder) you actually worked and the monthly pay it has resulted in.

Tillæg: Additions or supplements to your basic wage, such as through overtime, bonuses or seniority perks.

Sources: borger.dk (1), borger.dk (2), Serviceforbundet, SKAT (1), SKAT (2),

Are there any general or specific topics related to working, living, studying or anything else in Denmark that you'd like us to write about in detail? Let us know -- we'd like to hear your suggestions.

Comments

See Also

Our guide helps you to understand your payslip and the terminology used for salary paperwork.

Generally (but not always), if you are an employee at a Danish company, you will receive your wages once a month, usually on the last or first working day. You should also get a wage slip or payslip: lønseddel in Danish. The payslip can be considered a receipt showing how much you have been paid and what you receive net taxes.

Your name, address and personal registration or CPR number along with the period covered by the payslip should all be included on the paperwork. Your employer’s name, address company registration (CVR) number and the day’s date should also be stated.

You will see the following terms accompanied by a corresponding amount:

AM-bidrag

AM-bidrag or arbejdsmarkedsbidrag, literally ‘labour market contribution’ is a taxation amounting to 8 percent of your wages. It is paid directly to the Danish Tax Agency (SKAT) by your employer (for those who are not self-employed or freelance).

Your wage slip will tell you the amount to which this 8 percent taxation is applied: some parts of your gross income are not applicable to the AM-bidrag. More information on this below.

A detail from a Danish payslip.

A-skat

This is the primary form of income tax, paid directly to SKAT by your employer on your behalf.

Your payslip will also tell you how much of your income A-skat is applied to after supplements and deductions are applied to your gross wage. The amount you have already paid as AM-bidrag is deducted, for example as are pension contributions and other deductions to which you may be entitled.

ATP-bidrag

ATP stands for Arbejdsmarkedets Tillægspension, which translates to ’labour market pension contribution’. This is a pension into which you are legally obliged to pay and which supplements the state pension (folkepension).

Your employer pays two-thirds of the ATP contribution, you one third comes from your wage. This is the amount you will see on your payslip.

How much you actually pay depends on how you receive your wages, but if you are paid monthly it will be 94.65 kroner (for 2019). Your employer contributes 189.35 kroner, adding up to 284 kroner per month.

AM-Pension

Arbejdsmarkedspension and other pension contributions will be recorded on your payslip. You may see the terms AM-pension firma or AM-pension egen, depending on the type of pension you may pay into.

Read more about how pensions work in Denmark here.

Feriepenge

Feriepenge or ‘holiday money’ is a monthly contribution paid into a special fund, depending on how much you earn.

You can claim back the money once per year, provided you actually take holiday from work. You will be notified when the money can be paid out around May, and directed to the borger.dk website, from where you claim it back from national administrator Udbetaling Danmark.

There are two sub-types of feriepenge. These are ferie med løn, whereby you are paid while on holiday – in this case you are entitled to a supplement of about 1 percent to your wages. If you are not paid while on holiday, you will receive feriegodtgørelse as part of your wages and will see this on your payslip. This means that your employer is obliged by law to pay 12.5 percent of your wages in holiday money into the national pool for you to claim back each year, equivalent to five weeks’ holiday.

READ ALSO: What you need to know about vacation in Denmark – and how the rules are changing

A detail from a Danish payslip.

Whether or not you are entitled to paid holiday or the feriegodtgørelse wage supplement will likely depend on the contract or collective bargaining agreement you have, either as an individual or a member of a trade union.

READ ALSO: EXPLAINED: Should I sign up with a Danish union and get unemployment insurance?

Fradrag

Literally ‘(tax) deduction’, fradrag is the part of your income which can be exempted from taxation. It is calculated by SKAT based on information the tax agency has about you and on information provided by you to your employer. Your employer will be informed how much of your wage is encompassed by fradrag. Your net earnings will therefore reflect that you have paid A-skat on the part of your wage to which tax exemption or fradrag does not apply.

Fradrag can be given for a range of things, including membership fees for unemployment insurance (A-kasse) and trade unions and other expenses. You can check what your are entitled to here (in Danish).

READ ALSO: What Denmark's new budget proposal means for foreign residents

Two other important terms come into play here for people who have more than one employer: hovedkort (primary tax card) and bikort (secondary tax card). Your fradrag can only be applied to one employer at a time, so you should always ask your main employer to use your hovedkort for tax payments, and other employers to use the bikort. The bikort shows only your tax percentage and not the fradrag reductions to your tax payment.

Going further, because monthly wages tax returned via the bikort do not use fradrag, that does not mean you don’t get the tax deductions. These are calculated by SKAT after the event and you will be informed of them via two statements known as forskudsopgørelse and årsopgørelse.

These are both forms of yearly tax accounts. The forskudsopgørelse is issued in November and shows your expected income and tax for the coming year, and you can make changes to it to change how much tax you are paying if the information doesn’t match up with your actual earnings.

The årsopgørelse is an annual statement, released in March, and tells you your income for the past year and what you paid in tax.

If you have paid too much or too little in tax in relation to your earnings, this final statement will inform you of this and any subsequent tax rebates you may be due (you may also owe tax). The money is paid out or collected automatically.

Månedslønnet

If you are paid monthly, this word, which means ‘paid monthly’, is relevant and also means that your grundløn or basic wage will be marked on your payslip. This is the basic wage before any supplements are added and before tax and other payments are taken from your earnings. You will also see timetal or the number of hours you have worked – typically 160.33 hours for someone in full-time work, but dependent on your contract and other factors such as whether you work nights.

Further to this, normtid is your regular or expected working hours, and overtid denotes overtime.

Other terms:

Brutto: The Danish word for ‘gross’, i.e. the amount prior to calculation and deduction of tax.

Netto: Not a supermarket in this context, but the amount of wages you receive after tax.

Disponibel dato or disp. dato: This is the date your wages will be paid out into your bank account.

Enheder: Units, i.e. a month, an hour, a krone and so on.

Sats: the rate, for example an hourly wage or the percentage of wage you pay into a pension scheme.

Timeløn: your hourly pay rate. If applicable, you will see this together with the number of hours (enheder) you actually worked and the monthly pay it has resulted in.

Tillæg: Additions or supplements to your basic wage, such as through overtime, bonuses or seniority perks.

Sources: borger.dk (1), borger.dk (2), Serviceforbundet, SKAT (1), SKAT (2),

Are there any general or specific topics related to working, living, studying or anything else in Denmark that you'd like us to write about in detail? Let us know -- we'd like to hear your suggestions.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.